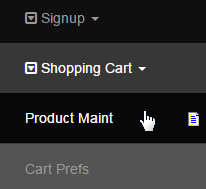

Setting up tax rates on indivual items overrides the general tax rates as specified in your system, based on the user type purchasing the item. The person will be charged tax on the item as specified separately. Go to Configuration > Shopping Cart > Product Maint from the left hand menu.

Select the product or the item for which you want to specify separate tax rates. Then click on the [Edit] link next to that item to bring up the Product Edit page.

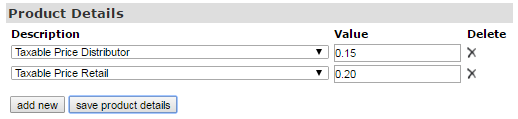

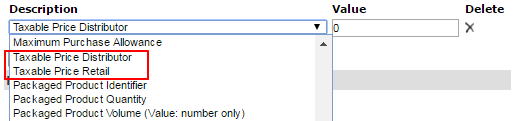

Now, scroll down to the Product Details section and click on the add new button to include a new line followed by selecting the options:

- Taxable Price Distributor: This is the price to be used for Tax Purposes when calculating tax for a Distributor. This value controls the Wholesale price of this item. It allows you to override the tax calculation for the distributor purchase of this item.

- Taxable Price Retail: This is the price to be used for Tax Purposes when calculating tax on a Retail Purchase. This value controls the Retail/Customer price of this item. It allows you to override the tax calculation for the retail purchase of this item.

Select your options from the drop-list and then set the respective values. Once done, click on the save product details button to commit to the changes. For example: Say, you have a package of nine items, out of which only one item in that package is taxable and rest eight of them are not taxable. In that case, you can state the taxable value of the package to be different than the actual value of the package with this function.