This is where you set the tax for the product or the item. Simply tick on the box under the Charge column for the corresponding Tax Name and then click on the save product properties button to save. The Countries Subjected column specifies the country names to where the tax is applicable.

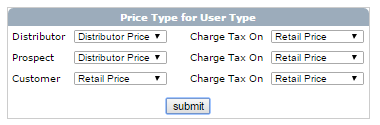

You can also set up the global default tax rates. For the setup, go to Shopping Cart > Cart Prefs and scroll down to the Price Type for User Type section. This is where you decide which price level to charge tax on for each user type. Select your option from the Charge Tax On drop-down menu.

Once you have completed the setup, click on the submit button below to save. To learn more about this feature, please see the Cart Prefs manual.

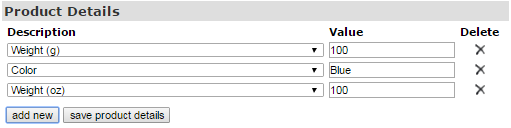

You may set a special tax rate per item if you wish to override the global tax rate settings for that particular item. This allows you to have different tax rates on particular items. Go to the Product Details section in the Product Edit page. Start by clicking on the add new button to insert a new line.

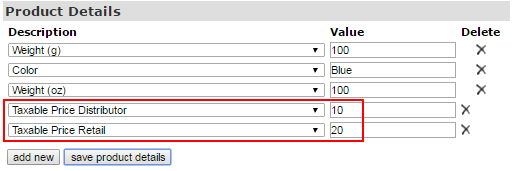

Now open the Description drop-down menu to select the following options as per your criteria. The two options we are interested in are:

- Taxable Price Distributor: This is the price to be used for Tax Purposes when calculating tax on a Retail Purchase.

- Taxable Price Retail: This is the price to be used for Tax Purposes when calculating tax on a Retail Purchase.

Once you set up the values for the options, click on the save product detail button below to save. A dialogue box should pop up showing Processed.